We recently increased our asset allocation to emerging markets and made some changes within our emerging market holdings. Our underlying research concluded that the best style and market cap for our emerging market equity holdings is to be biased towards large cap value. The reasoning for this is detailed below.

Value has outperformed growth and is at a large discount to growth within emerging markets

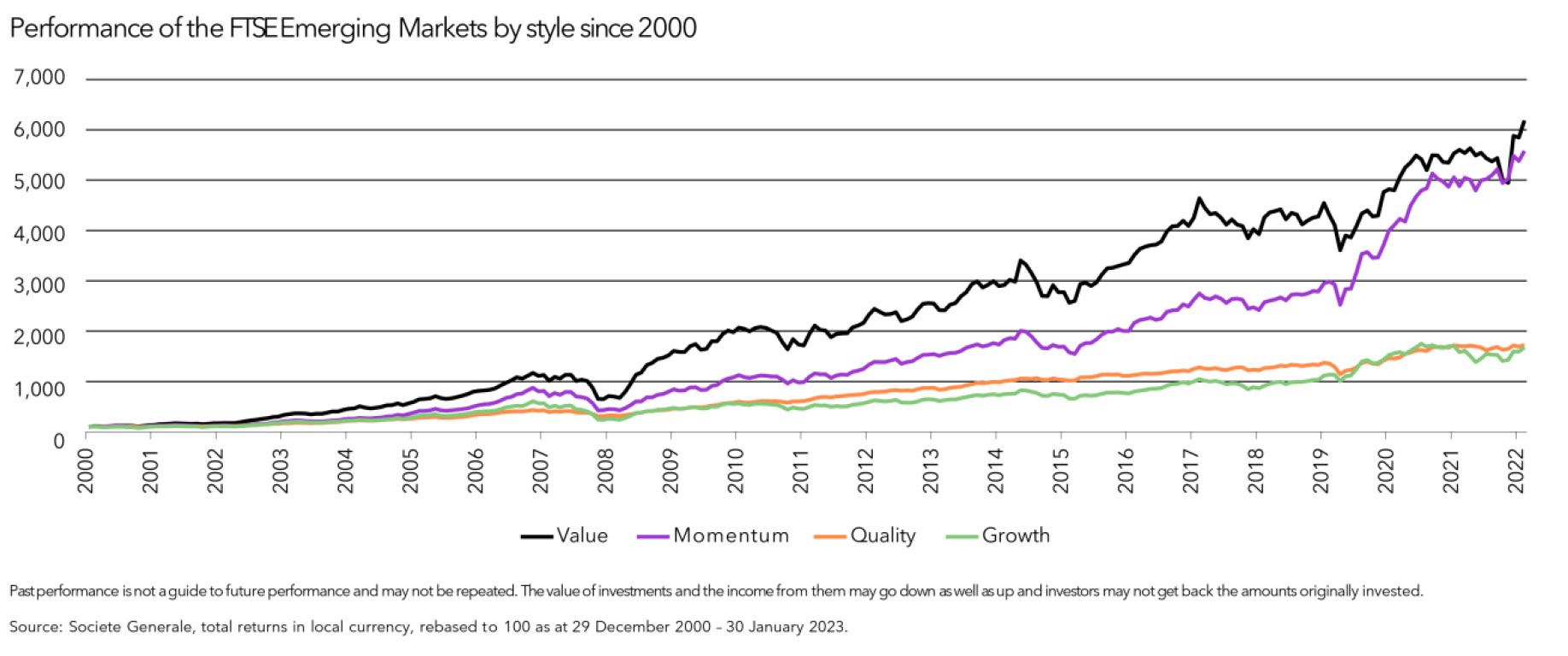

Over the last 20 years, value has proven to be the best returning style in EM

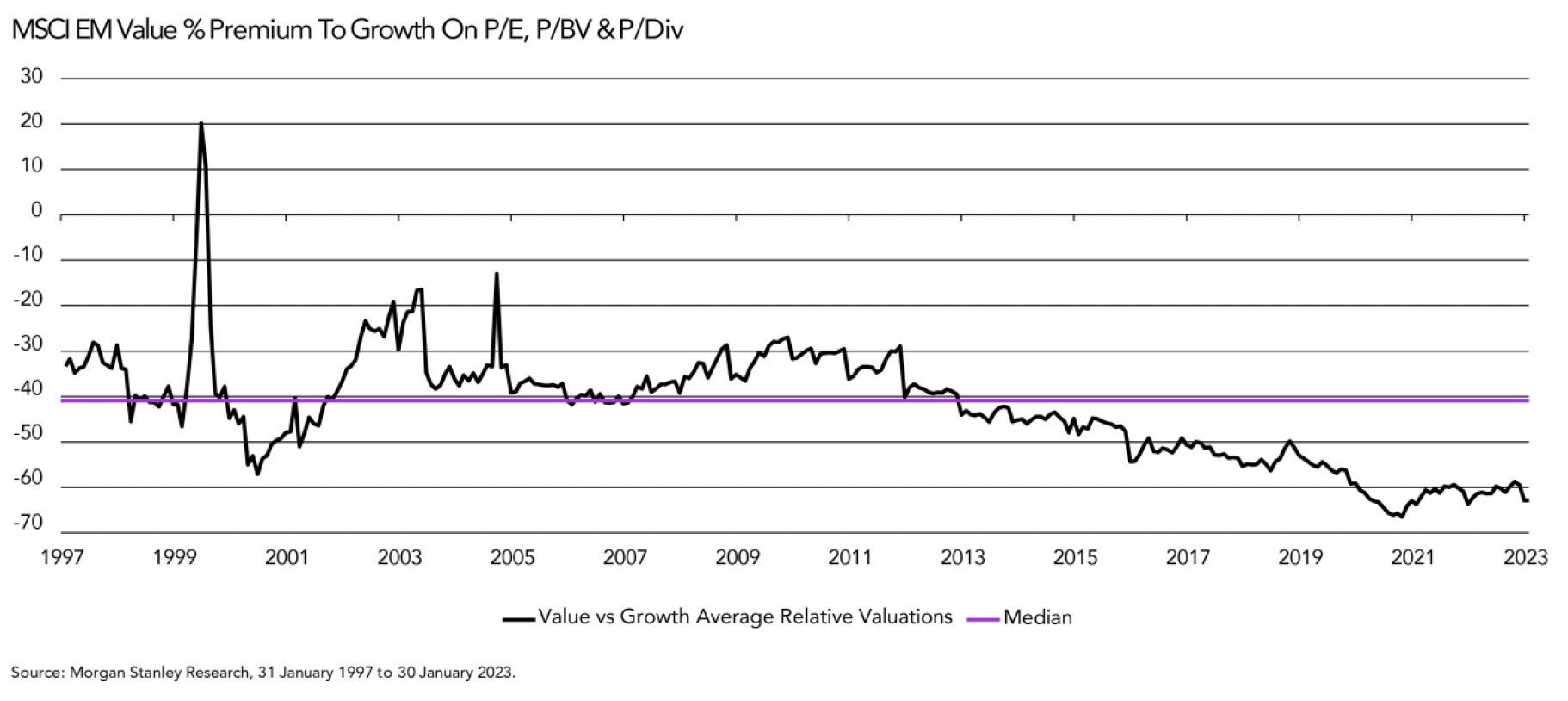

Even with the headwinds to global value over the past two decades, value as a style has outperformed growth within emerging markets. At the same time, the valuation discount of value compared to growth has continued to widen. This means that value has continued to get cheaper as growth has got more expensive, even with the outperformance of value investments.

Why now for Value in EM?

Market conditions are at extreme levels

Large dispersion of stocks within the value style

When researching the style, we found that the value style in emerging markets is extremely broad by country, sectoral and size differentials. There seems to be a wider breadth of stocks to invest in, meaning that there is greater diversification than many would think within a value biased strategy. This is important as it allows the underlying fund managers to have a diversified portfolio of best ideas and the underlying portfolio can be altered to match economic conditions as they shift.

Market dynamics should favour value

Another reason for focusing on value for EM, is the changing market dynamics that should lead to value having a better backdrop to work in than what has been present over the past decade. With the changing interest rate and inflation backdrop for many emerging market countries becoming more favourable, currencies being more positive and the opportunity for increasing their growth over time, the value style should perform well.

Companies with exposure to more cyclical industries and companies who focus on income generation should perform more favourably over time due to this backdrop.

Why active value EM?

Within our portfolios, we use active funds, alongside index tracking funds. When we run our analysis, we compare assets with similar styles and market caps to determine whether an active or passive approach offers the best opportunity for the long term.

What we found with Emerging market value is that the best opportunity to provide alpha is through an active manager who has experience in investing in EM, understands the nuances of the asset class and has experience of investing with a value led process. The reasons for this are as follows:

- The underlying EM index composition means there are opportunities to move off benchmark or away from the benchmark to allow for outperformance to occur. Asia is a big overweight with China, Korea and Taiwan making up 60% of the total index. Being active compared to the benchmark, which is overweight to certain sectors and countries, can help drive outperformance.

- There is large dispersion between regions and specific countries in EM. This means that active managers can extract alpha from actively managing exposure from a valuation perspective. The same is true for underlying sectors as well.

- As we have seen in developed markets, economic policy is leading to large divergence in future growth prospects of each emerging market country. Again, active managers can take advantage of these differences in their allocations.

- Finally, it has been proven that active managers in emerging markets have added value for investors compared to underlying benchmarks net of their fees over time (Source: Schroders 2023).

Why Schroder for active EM value

We picked Schroders because they are a dedicated emerging market team that sits within their larger global value desk. The wider team are renowned for being value specialists with a strong investment process. They take value investing seriously and will not deviate from this style.

We were also very impressed with the two fund managers who have been running the fund since its inception. Both are emerging market specialists. This is key as emerging markets are very different to developed markets and so having this experience as well as both being from emerging market countries themselves, we think, will help provide outperformance.

In conclusion

We believe that our in-depth research of emerging market equities has unearthed an excellent emerging market fund to invest in for the long term. We are pleased that we have found an active value fund that is run by a team whose mantra is that ‘value is not a factor….it is a timeless universal philosophy’ and we think this will allow our EM allocation to outperform over time.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.