The investment team here at MAIA have been researching opportunities to increase our exposure to emerging markets for over a year now. We have been monitoring the risk and opportunities within emerging market equities to evaluate whether now is the best time to increase our exposure to a major part of the future growth engine of the global economy.

The negative risks of higher inflation, interest rates and potential lower growth have all been priced into the valuations of many emerging market stocks and as many of these risks are receding, we are confident now is the right time to take advantage of the lower valuations that are available across many emerging market countries.

How cheap are emerging market equities?

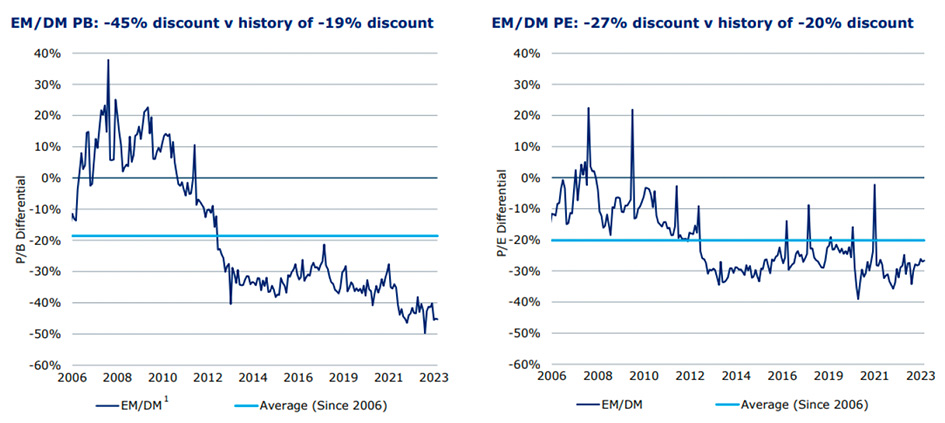

As the chart below shows, both the price to book and price to earnings valuations for emerging market equities are far below their long-term average when compared to both historic data in this sector, as well as developed market equities. There are differences between individual emerging market countries, but emerging market valuations overall are at some of their widest discounts compared to developed market equities.

This is an excellent entry point for long-term investors. As the valuation discount narrows this should lead to outperformance for emerging market equities over time.

Source: Federated Hermes 2023

What about the risks for emerging markets?

Headwinds from the strong US dollar:

One of the major headwinds for investors within emerging markets is the impact of a rising US dollar. As many emerging market economies have links to the US through debt or the US economy, the US dollar is an extremely important factor driving the opportunities for emerging markets.

Many economists predict that the strength of the US dollar may recede over time as the US Federal Reserve finishes their latest interest rate hiking cycle. For some emerging market (EM) countries, we have already witnessed some weakness in the US dollar currency pair, and if this shift continues across other EM currencies, this will provide a positive backdrop for EM equities.

As the dollar weakens, growth opportunities increase for emerging market countries. Flows into their currencies rise and foreign capital increases, which goes towards fiscal spending. All of this improves emerging market prospects further.

Negative sentiment dominating emerging markets:

As has been the case for several years, sentiment towards emerging markets continues to be weak.Many other investors are solely focusing on the political risks in Asia, Eastern Europe, and Latin America. In doing so, they are waiting for the impact of these risks to diminish before increasing allocations to EM.

Investing in this way will not provide the best opportunity to outperform over time. Equity markets move extremely quickly and trying to time a long-term investment on news flow and sentiment is an extremely difficult thing to do.

A far more prudent way to work is to evaluate the current risks and opportunities and decide whether the time is right to invest for the long term. By waiting you could miss the greatest returns.

Our research has shown that we have reached a positive inflection point where the long-term opportunity for emerging markets is constructive for investors, even with the current political and economic risks that are present. Therefore, we have recently increased our emerging market allocation within our portfolios.

Focus on the positive fundamentals.

Alongside the positive valuations, pricing and the macro environment, recent changes in underlying fundamentals have highlighted to us that now is the best time to allocate more to emerging market equities.

We expect the good news to continue but active selection is key in such a diverse marketplace. With the lack of coverage in emerging market stocks in general, utilising an active manager that can be selective should provide the best opportunity to outperform over time.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.