As we have spoken about before, we introduced long duration UK gilts to our portfolios at the end of 2023. Following a period of higher inflation and higher interest rates, and with the headline yield on bonds far higher than what had been the case for many years, our team made several adjustments to our fixed income allocation. Including adding exposure to longer duration UK government debt through an index tracking fund with the view that central banks were winning the war on inflation and nearing the end of the interest rate hiking cycle.

Performance and Future Prospects

Since our initial investment, market conditions have been highly volatile, creating both challenges and opportunities. Inflation has remained more persistent than many central banks initially expected. As a result, gilt yields have not fallen as quickly as the market had anticipated. On the other hand, concerns over slowing economic growth have also increased as well as rising fiscal deficits, increasing trade disputes, new tariffs and ongoing geopolitical conflicts which have all placed downward pressure on yields at times.

These conflicting forces have resulted in significant fluctuations in gilt yields over the past year. While the expected fall in yields and corresponding price appreciation has not yet materialised, we remain confident that this will occur over time.

Why Do We Still Believe Gilt Yields Will Fall?

Given recent yield movements, investors may question why we still expect a decline in yields and, consequently, an increase in gilt prices. Our conviction remains strong because markets are currently fixated on the short-term inflationary effects of tariffs while overlooking the longer-term impact of broader economic policies on growth.

Central banks can tolerate short term inflation spikes, but they cannot ignore weakening growth and rising recession risks. In response to these pressures, we believe interest rates will have to be cut faster than the market currently expects, driving gilt yields lower and gilt prices higher

While inflation may remain elevated in the near term, the combined effects of restrictive global trade policies, reduced consumer spending and lower investment should exert greater downward pressure on interest rates. This suggests that rate cuts could exceed current market expectations.

Although it may take longer for this scenario to unfold, we see short-term inflationary pressures as temporary. The Bank of England is likely to disregard these short-term fluctuations unless inflation shows signs of becoming persistently high and embedded in the economy.

Is There Evidence That the Bank of England Is Prioritising Growth Over Inflation?

The last two bank of England policy meetings underscored the difference between the market perception of future interest rates and what the bank of England are looking at. As markets had predicted, interest rates were cut by 25bps in February and left unchanged in March which was fully priced in. However, it was the members vote split which was more intriguing. In the February meeting, the vote split was 7-2 for either 25bps cut or a 50bps cut with one of the previously more hawkish members now voting for a 50bps point cut. In the March meeting there was an 8-1 split to hold interest rates at current levels with one member voting for a cut.

This voting split is intriguing and highlights how the underlying views of the committee is changing. The hawkish members of the committee have switched from interest rate increases to holding rates or cutting. We think this shows that the bank of England is looking through temporary inflation trends to the longer-term impact of lower spending and consumption on growth.

Looking Ahead

While we anticipate that the Bank of England will have to cut rates more aggressively than currently priced in, this does not mean they will ignore near-term inflationary pressures. However, once inflationary base effects subside, we expect rate cuts to accelerate beyond current market forecasts.

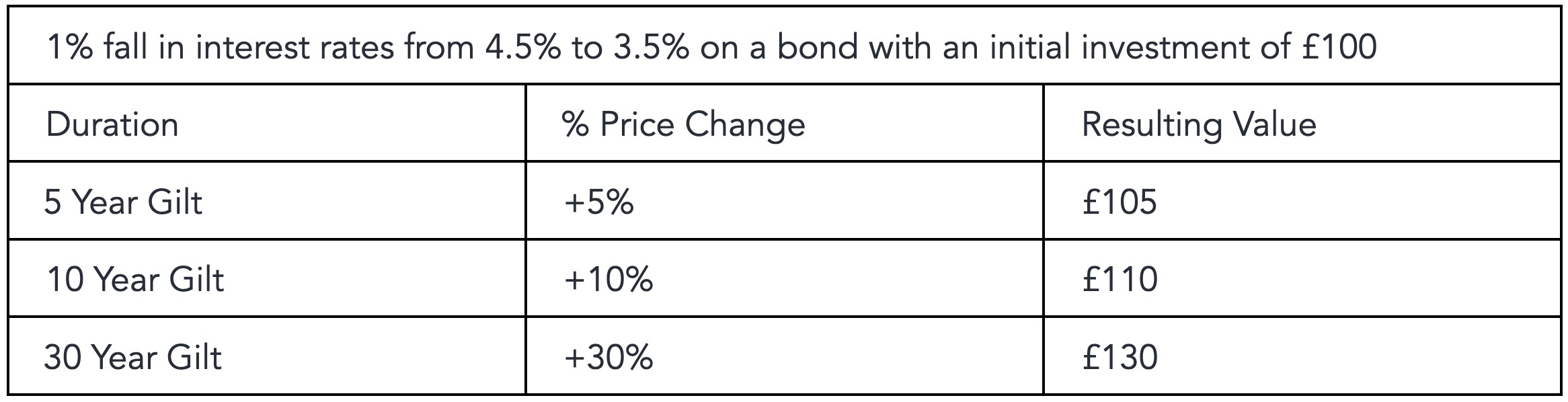

The table above illustrates the capital appreciation potential of a long duration bond, if yields were to decline by 100bps in response to a 1% base rate cut. This return is an illustration of what may occur in addition to the coupon income generated by a highly secure government-backed asset. Even modest rate reductions could generate attractive returns, with more substantial cuts amplifying gains.

We believe this presents a compelling investment opportunity. More importantly, should rates decline more quickly due to deteriorating growth prospects, the diversification and return potential of this position will be even more valuable, particularly in an environment where other assets may experience increased volatility. This is why we continue to hold our long duration gilt allocation within our portfolios.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.