Equity Income plays an important role in our portfolios. Some investors may solely focus on capital growth; however, we believe that focusing on income as well as capital growth can provide investors with a stable return profile that works in most market conditions.

Why are dividends important?

Dividends for Income

Firstly, dividends are important as they can provide a regular source of return for investors whilst helping to identify high quality companies. If companies continue to produce positive cash flows, these can be paid out to investors as dividends. This means that shareholders can access income without the need to sell their shares.

Dividends Highlight Quality

Companies that increase their dividends over time demonstrate the strength of their underlying businesses. High quality businesses that continue to grow cash flows and profits can pay excess reserves out as dividends, which rewards shareholders and may also attract increased investment from new and existing shareholders. If investors understand the quality of a business, they are more likely to invest more over time, which can increase share prices even further.

Dividends account for a high proportion of stock market returns over the longer term

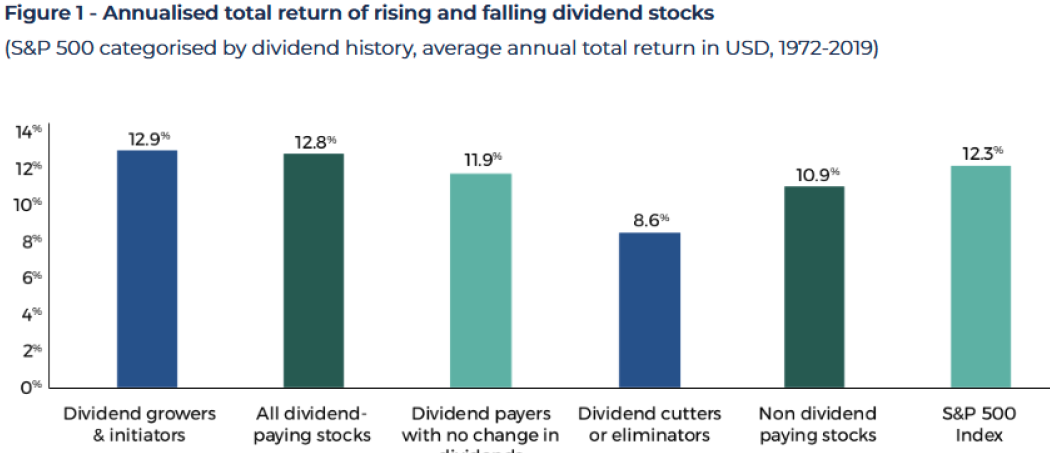

Source: Guinness Asset Management & Ned Davis Research November 2023.

Many studies have shown the importance of dividends and dividend growth to form the basis of long-term returns for investors. As the graph above shows, over a fifty year period, dividend growers have provided the largest annualized return percentage compared to non-dividend payers and dividend payers that have not grown their dividend over time.

Dividend focused companies in the current market backdrop

During the global pandemic many dividend paying companies were forced to cut or cancel their dividends, however the dividends from these companies were swiftly reinstated as we moved out of lockdown.

Since then, many investors have been ignoring income and dividends and are still focusing solely on growth. We think this is the wrong thing to do when you see the dividend growth that has occurred since 2020 as well as the predictions for it to continue moving forward.

How do we invest in our portfolios?

Within our portfolios, we invest in growth, value, and income strategies. Where we believe that an income focus will provide positive opportunities for investors, we invest in equity income funds.

Instead of just focusing on headline yield for the equity income funds we invest in, we prefer to focus on both dividend yield and dividend growth.

Why focus on dividend growth?

With the increase in bonds yields and cash rates that we have witnessed over the past three years, there is now increased competition for capital across different asset classes. Today, investors can receive 4-5% by investing in US Treasuries or UK Gilts. This is a far higher level of competition for equities than we have seen for some time. One way of offsetting this competition is to own higher yielding shares who generally pay a greater amount of dividend yield and can grow this income over time.

A company that can pay a high and increasing dividend over time becomes cheaper from a valuation perspective which should increase capital appreciation in its share price. It should also lead to improving fundamentals which will allow the business to continue to provide dividend growth over time.

Income and dividend growth funds in our models

One of the equity income holdings that we own is JOHCM UK Equity income fund. The fund is currently yielding 5.8% and the team are predicting dividend growth of 5.5% which will increase this yield further. As the team pointed out to us in a recent call, since the inception of the fund, the dividend payout has increased fivefold from 4.3p in 2005 to 24.7p in 2023.

‘The power of compounding and the potential for it to reoccur is a key differentiator between this fund and other higher yielding income funds’ (Clive Beagles JOHCM UK Equity Income). The dividend payments to investors since inception would have more than offset any initial capital investment, highlighting why dividends are important not just for income seeking investors but investors who are looking for a positive total return.

Another income holding which plays a pivotal role within our portfolios is the Liontrust Global dividend fund. The headline yield of the fund is currently 1.9%, which is in line with the MSCI World index, however the fund isn’t focusing on headline yield. What they are looking to do (which they have achieved for several years) is to provide above market dividend growth. Over the past five years the average dividend growth within the fund is 7.9% and the team are predicting similar dividend growth again this year.

SPDR US Dividend Aristocrats fund is a key holding within our US exposure especially for lower risk portfolios and focuses on dividend growth. A dividend aristocrat is a stock that not only pays a dividend consistently but increases its dividend at least annually. For this ETF, the criteria for a stock to be a holding, is that the underlying company has had to increase its dividend annually for at least 20 years. The stocks that are invested into are selected from the S&P1500 (the 1500 largest stocks in the US market) and the focus on increasing dividends means that the fund has a bias towards dividend growth not just a high-income yield.

Finally, our main European holding, Lightman European fund focuses on cash flow and dividend growth within its investment process, even though it is not an income fund. The reason for this is that the team believe that investing in this way provides positive defensive values. It also allows access to quality businesses that provide a total return for investors whilst reducing duration risk in the fund. As the team pointed out to us recently during an update on the fund, ‘dividends are at the heart of investing. Investing is not a charity, and we are not here to speculate on prices but to get something in return for our capital. Dividends are that reward’ (Rob Burnett Lightman November 2023).

In Conclusion

Equity income focusing on dividend growth will continue to be a major factor within our global equity allocation. Focusing with a total return mindset, we believe, is key to generating outperformance in all market conditions for our underlying investors.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.