For several years now, our asset allocation views have led to the portfolios being underweight fixed income as we have felt that there have been better opportunities available in other asset classes.

Our fixed income holdings have been focused on shorter duration credit which provides greater protection in a rising yield environment.

We also allocated to global corporate credit, including high yield and emerging market debt, where the headline yield is higher than other fixed income assets.

The team felt that yields were too low and credit spreads were very tight, especially in longer duration assets, and so this wasn’t compensating investors for the risk that yields could rise and spreads could widen.

Over the past few years, higher inflation has led to interest rate increases by central banks globally and so bond yields have risen in line with this. Longer duration assets have suffered the most as their interest rate sensitivity is higher.

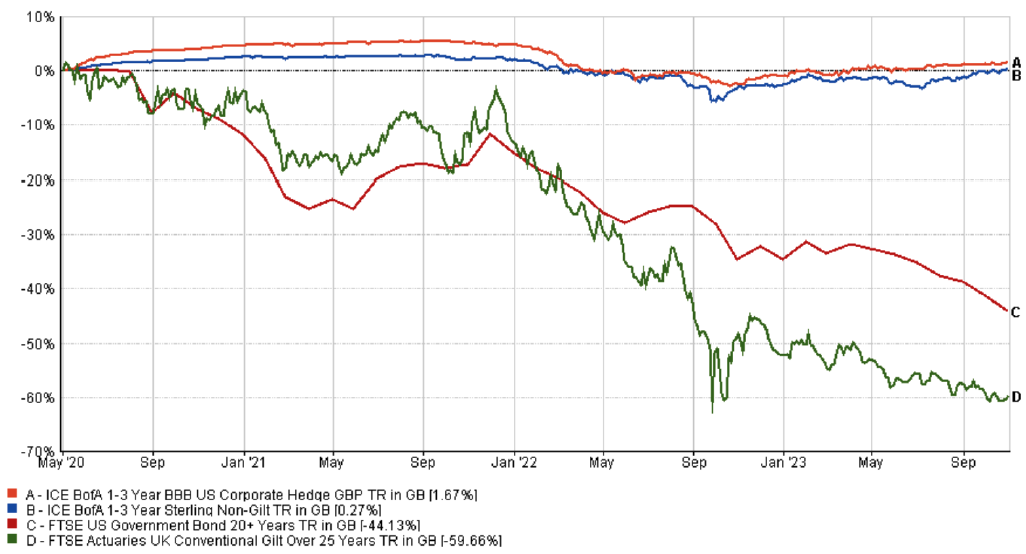

This is highlighted below where we compare the returns of short dated corporate debt to higher duration government debt in both the UK and US.

Source: FE Analytics November 2023

As the graph emphasises, being shorter duration has provided capital protection for investors (the orange and blue lines). The yields in UK government 30-year bonds have risen from just over 0.50% at the height of the pandemic to 5.0% as at the end of October 2023. This amounted to a 60% loss in these bonds.

Being shorter duration during this time has helped with the downside protection in our portfolios.

Now we are nearing the end of the hiking cycle – is the tide changing?

The team believe that fixed income as an asset class is now providing better value for investors.

Why is this the case?

1) Central banks are winning the war on inflation. Real yields (the return after inflation) for bonds are mostly in positive territory and we believe this will continue over time as inflation continues to fall. This means that holders of these bonds are now being compensated for the risk of higher inflation by having a yield that is generally greater than the rate of underlying inflation.

2) The starting yields on bonds are far more positive. The headline yield on bonds is far higher than what has been the case for several years, meaning that the coupon payment is higher for investors. We had previously not liked the fact that many fixed income holdings were providing very low income to investors.

3) We are near the end of the current interest rate hiking cycle. As inflation continues to fall, the need for central banks to raise interest rates further diminishes. It also creates the opportunity for interest rate cuts to occur in the future.

This is where fixed income becomes a key component for investors as a slowing growth environment is generally positive for bonds, as yields will fall in line with cuts to interest rates providing a capital return on the bond’s price.

Has this led to a change in our thinking about fixed income?

We are continuing to hold our higher yielding assets, as we think these bonds provide positive yield uplift and differing sources of alpha within our fixed income allocation.

We are reducing our exposure to short duration credit and investing the proceeds into longer duration corporate credit and UK Gilts. Both are now pricing in a very positive uplift following the substantial losses that have been witnessed in longer duration assets over the past three years.

Why long duration gilts now?

The average price should provide capital upside:

The average bond price in the Gilt fund we are investing in is under £75, with a par price of £100. This means that when these bonds move towards maturity, their price will increase back towards their par value. Bonds have a very strict process of periodic coupon payment over a fixed term, with the principal par value being paid at maturity.

As we are investing in UK government debt the chances of default (where the principal par values are not paid) are minimal, meaning that we should benefit from the capital uplift of a return to par value on the underlying bond price.

The average yield is now much higher:

Yields in UK government bonds have reached levels not witnessed for over 20 years and provide investors with a very healthy yearly coupon if bought at today’s levels.

To put it into context, for investors now looking to invest in a UK 30-year bond today, the nominal total return for the investment (coupon & return of par value) is over 340% for the life of the bond. This compares to a return of 27% for a 30-year UK Gilt that was purchased when its headline yield was 0.8% in 2020.

The economic backdrop is conducive for positive returns in the short term:

As we are nearing the end of the current rate hiking cycle, the opportunity for returns is positively tilted to investing in these bonds now rather than waiting.

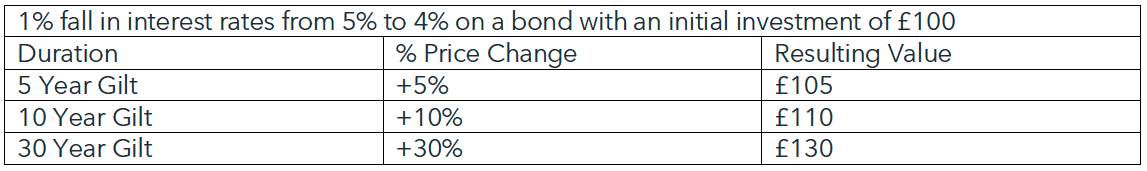

If central banks do look to cut interest rates over the coming years, long duration Gilts will provide investors with potentially large returns as and when interest rate cuts are introduced. In an interest rate cutting cycle, longer duration assets provide larger returns as their interest rate sensitivity is higher. For a UK 30-year Gilt, a 1% interest rate cut will lead to a 30% increase in capital value at that point in time for the holder, whereas for a shorter duration 5-year bond the capital uplift would only be 5% in this scenario.

In Conclusion

We believe now is the time to adjust our fixed income holdings and increase our weighting to longer duration fixed income assets as this type of opportunity does not arise very often. We have allocated to long duration Gilts through the iShares over 15 Year Gilt Index and Vanguard Long Duration Gilt, alongside Church House Fixed Interest for our duration managed corporate bond allocation.

The team wanted to implement an overweight to these fixed income assets from a tactical asset allocation perspective, to generate positive returns for investors over a short to medium term timeframe. Our strategic asset allocation, or long-term view, is that we will be shorter duration in our bond holdings as per the reasons above, but because of interest rates plateauing and then likely coming down next year, in our view, we have made some tactical asset allocation, or shorter term, changes and increased duration. Yield, diversification, and alpha generation are key, and we will continue to manage our weightings and duration within our fixed income holdings to provide the best return for investors over time. We will continue to hold fixed income alongside our alternative and equity assets as both these areas also continue to have positive return prospects.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.