At the time of writing, savers are benefiting from the highest cash returns on offer for nearly two decades.

We understand that as advisers, you are receiving more questions around cash and cash investments from your clients. With the increase in savings rates, it is understandable that more clients are now looking into cash saving products for their investments. However, just because interest rates are now above 5%, it does not mean that cash is right for all investments and all clients over the long term. Remaining invested in global markets and asset classes has proven to, and should continue to, provide the largest returns and more importantly the largest real returns to investors over time.

The best asset classes to provide positive real returns.

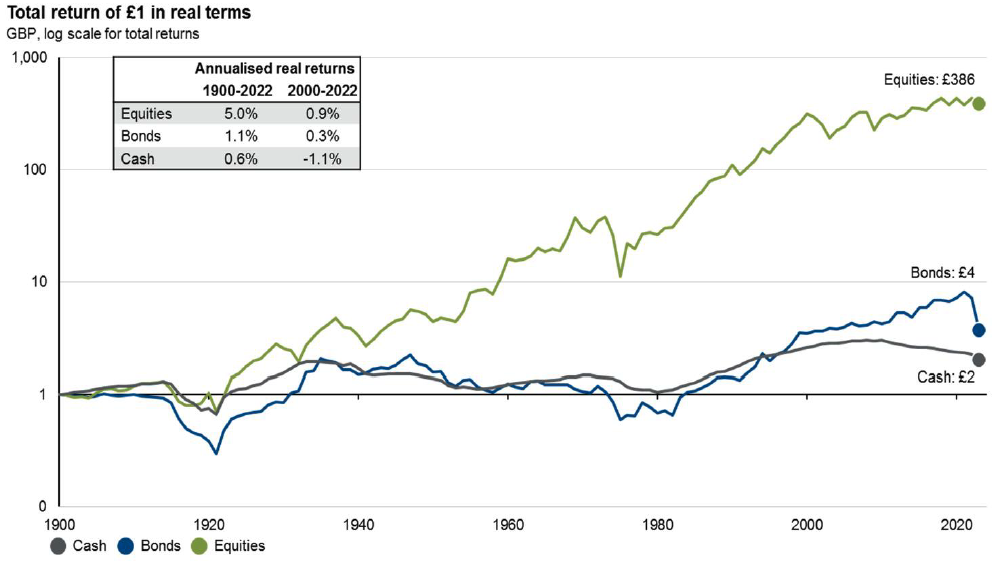

Real returns are important for all investors. Real returns mean that investors do not lose purchasing power due to the impact of inflation and rising prices. Whilst equities may be more volatile and have a greater risk compared to cash, investors are being compensated for this by the greater opportunity of generating a positive real return. Equities can work well for long term investors over differing market periods, not just a low inflation and low interest rate world.

The graph below shows how much a £1 Investment would be worth in real terms if it was invested in equities, fixed income and cash. The time frame for investment is extremely long, but it does highlight how equities compound their returns at a higher rate which can lead to better returns for investors.

Source: JPM Guide to the markets, June 2023

What about recent returns for equities, cash and other investments?

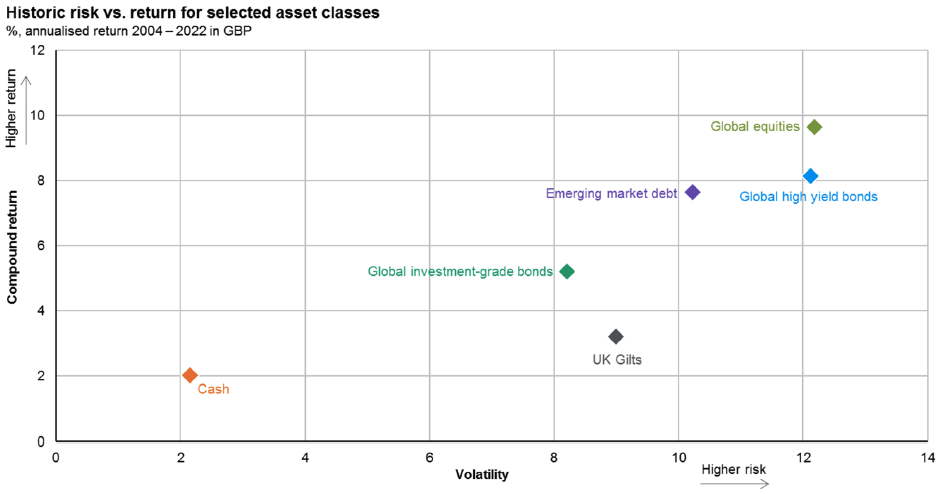

For the past few years, investment markets have been extremely volatile due to political risks, the fallout from the Covid-19 pandemic, the on-going war in Ukraine, tensions now erupting in the Middle East, high inflation, and rising interest rates.

Over the longer term, cash usually will not provide the same return opportunities of equities, alternatives and fixed income.

Source: JPM Guide to the markets, June 2023

What about the future?

It is not possible to precisely determine what will occur in global markets over the next few years. However, we know there is implicit value in many asset classes globally.

Fixed Income

As interest rates have risen, so have the underlying yields on fixed income bonds. This has led to fixed income providing investors with negative returns over the past couple of years. However, this recent underperformance has now led to opportunities arising in many fixed income assets.

Unlike cash deposits, the yields on bonds are generally higher than interest rates, as investors demand a premium for the extra risk they are taking by lending their money to a government or institution, rather than placing it with a bank.

This means that headline yields are generally higher than cash rates. If the bond that is invested into does not default, the holder will receive this yield until its maturity and will also receive the bond’s initial investment amount (known as par value) as well.

The headline yield on bonds are materially higher now than they were over the past few years and the bond’s price is also below par values. This means that along with the yield on offer, capital upside will occur if the bond does not default. This means investors could receive more than 10% per annum in some cases for investing in what is generally perceived as a lower risk investment. This is higher than current rates available for cash investors.

Infrastructure

Another asset class that is held in our portfolios is infrastructure. Infrastructure is a key investment area due to the long-term opportunities that have arisen due to the increased need for additional fiscal spending on global infrastructure projects.

We believe the picture for infrastructure is extremely positive. The infrastructure funds we invest in are currently predicting an annualised internal rate of return of more than 12% over the next five years, which is significantly larger than the rate of return on cash currently.

What is also important for infrastructure is that the return profile does not usually diminish in an interest rate cutting cycle, which will impact cash rates materially. In past cycles when interest rates have been cut, infrastructure assets have outperformed the broader market as, when the economic backdrop improves, investors look to infrastructure due to its higher yielding qualities.

Defined Returns

Defined return funds provide investors with a known return if certain investment conditions are met. The outlook for defined return funds is positive due to the pickup in interest rates and higher volatility that has been present in markets over the past two years.

The defined return funds we currently invest in are predicting 8% plus returns per annum from here even if markets do not move upwards from current levels.

Even if markets fall from current levels, the protection barriers in place within the underlying securities means that over the longer term, the returns for the funds are still positive providing markets do not fall by more than 30% and remain at that level until all of the underlying holdings mature.

We think this is an extremely positive outlook for investors, as losses in markets can occur but the defined return funds can still provide a positive return. In a negative market scenario led by poor economic conditions, the returns available for cash will fall as interest rates are cut, but as highlighted above the returns on the defined return funds could still increase further if certain parameters are met.

Equities:

Across our equity holdings, we invest in different styles, geographies and sizes. The reasoning behind this is that it provides diversification and differing sources of alpha.

All of our equity holdings have positive long term valuation metrics which will drive performance for investors over time.

Looking at our UK equity holdings in particular, the UK market as a whole is undervalued compared to other markets. In past periods where UK equites have been undervalued, their performance has been extremely positive, and we expect the same to occur this time as well. We also expect this to occur in our Emerging Market equity and European equity holdings as they are also valued extremely favorably compared to other markets and their own history. In these periods the return profile has been higher than average and there is no reason this cannot occur again, which should far outstrip the return prospects for cash over the same period.

Another area within our equity holdings that offers very good value currently is within our income and dividend paying holdings. The dividend paying funds provide investors with a positive real return above inflation, and due to the dividend growth attributes within the holdings, the income generation should continue to increase over the longer term as well. This is key to allow for real returns to continue for investors meaning that the total return should be far greater over time.

One example of a fund that is held in the portfolio is JOHCM UK Equity Income Fund which has grown its dividend by over 500% since the fund’s launch. With a headline yield of 6% and with an average dividend growth of 8% per annum, JOHCM UK Equity Income Fund should provide investors with excellent return opportunities in a diverse range of market scenarios over time alongside our other equity income and dividend growth focused holdings held within the portfolios.

In Conclusion:

For investors, the choice of where to invest has changed with interest rates being increased over the past few years. The factors influencing the interest rate increases have created volatility in global investments.

However, as highlighted above, cash does not outperform over the long term. The recent increase in volatility in markets is providing positive opportunities across all the asset classes for investors who are happy to invest for a longer period of time. Time in the market, not timing the market, is the proven strategy to provide the best return opportunities for investors.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.