Here is a Citywire article that came out today in New Model adviser of Vanguard against some boutique MPS providers. The full article is below.

How smaller DFMs were able to beat Vanguard LifeStrategy

The secrets of the active asset allocators and passive zealots that have beaten Vanguard’s flagship £42bn multi-asset range.

How do you outperform a £42bn investment giant like Vanguard LifeStrategy?

The passive multi-asset range is one of the most popular solutions in the UK, having won over advisers and clients with low fees and a simple investment concept.

It has also delivered strong long-term returns. When Citywire looked at how the performance of wealth managers’ portfolios stacked up against the LifeStrategy range earlier this year, the passive Vanguard range clearly won out over the long term. All five LifeStrategy funds delivered stronger performance over 10 years than comparable ARC indices, which aggregate the returns wealth management groups have achieved in actual client portfolios.

However, over the medium term, which featured the turmoil of the pandemic and rising interest rates, the picture was more balanced. When it came to discretionary fund manager (DFM) portfolios with lower equity allocations, Citywire found that the lower-risk ARC indices had delivered higher and more consistent returns over five years.

For this follow-up piece, Citywire spoke to some of the smaller DFMs that have beaten LifeStrategy since the start of 2019 to find out how they did it.

Given big weights in long-duration bonds were the key factor in Vanguard’s underperformance during the period, alternative diversifying and hedging assets generally played an important role for successful investment managers.

As we move through the second half of 2024, the argument around bonds in multi-asset portfolios will continue to evolve. Another theme that emerged from conversations is that when interest rate cuts do come, as they now have in the UK, LifeStrategy’s more traditional 60:40 portfolio could be in a sweet spot.

Pitting active judgement against passive rules-based investing may also miss part of the debate.

Beyond Vanguard, there is another group of ‘evidence-based investors’ that have also had success – and in the case of Timeline, seriously rapid asset growth – using a similar passive-led approach but dispensing with the home bias and long duration that have cost LifeStrategy in recent years. In a sense, they have been outdoing Vanguard at their own game.

Away from fixed income and into alts

MAIA Asset Management is one DFM that has beaten LifeStrategy in many portfolios.

Looking at the same five-year period to the end of 2023 considered in the original analysis, the firm’s Smart Beta Cautious MPS returned 27.4% versus just 8.5% for the equivalent Vanguard LifeStrategy 20% Equity fund.

MAIA also beat Vanguard in the classic balanced category, akin to the 60:40 portfolio, a feat achieved by far fewer DFMs based on our prior analysis of ARC data. The firm’s Smart Beta Balanced portfolio returned 40.5%, versus 33.6% for LifeStrategy 60% Equity.

The range is predominantly constructed using index-tracking funds. But MAIA’s Simon Jackson (pictured) explained how his team boosted performance by looking beyond equities and fixed income.

‘We’ve got quite a large alternatives bucket, which includes things like defined returns, funds with structured products, infrastructure and gold,’ Jackson told Citywire.

The investment manager also spoke to the benefit of tactical asset allocation. ‘Within fixed income, we were heavily short duration, mainly credit-focused,’ he said.

That all meant he and his team were less exposed to the government bonds selloff that pushed LifeStrategy deep into the red in 2022.

The firm continues to hold strategies, like the Atlantic House Defined Returns fund, that essentially invest in structured products within a wrapper that can be put into a model portfolio service (MPS).

‘What you don’t want is everything correlated to one, and going up and down together,’ he said. ‘That’s what we’re looking for in that space.’

Regarding why those successful tactical allocation calls are repeatable, Jackson said he and his team had shown the ability to add to cheap asset classes at the right time – for instance, topping up UK equities in June 2020 when they had ‘fallen off the face of a cliff’.

In a more recent example, MAIA’s attitude to bonds has shifted. The firm upped duration and credit quality coming into 2024 – adding to long gilts exposure – given the dual appeal of attractive yields and renewed potential for capital upside if rates are cut.

Commodities and inflation

In an inflationary environment, commodities were also a major help to some DFMs.

The Saltus Multi Asset Class Cautious portfolio delivered a 15.1% return over the five years to the end of 2023 while targeting a volatility level about one-third of the global equity market.

Charles Ambler (pictured above), the firm’s co-chief investment officer, said his team also had a ‘very, very low’ weighting to fixed income. Coming into 2022, bonds made up only about a fifth of the asset allocation, or ‘around a quarter of what you’d expect to see in a cautious portfolio’.

‘Relying on two assets to stay uncorrelated is risky,’ he said, ‘especially with the spectre of inflation coming back.’

Absolute return funds made up a fair amount of the alternatives exposure. But late in 2021, Saltus also started building a commodities position, which was halved around June 2022 after a roughly 35% gain when most other asset classes had fallen.

‘It served us very well at the start of 2022. We’d never historically held a direct commodities position,’ said Ambler.

Credo, which delivered a LifeStrategy-beating five-year return of 38.5% in its 60:40 Multi-Asset Portfolio Core portfolio, also spoke to the value of commodity exposure during that period.

‘When it comes to investing outside of equities, apart from investment grade fixed income we avoid the common asset classes you tend to see, such as Reit and high yield, and instead have allocations to commodities and managed futures,’ Calvin McLean, head of multi-asset at Credo, told Citywire.

‘Both asset classes have a history of performing well in an inflationary environment, as proved to be the case again this time.’

While commodities exposure is now less than other alternatives, Credo still holds the L&G Multi-Strategy Enhanced Commodities ETF.

The other ‘evidence-based investors’

The debate has so far been framed as investment managers making dynamic asset allocation calls versus Vanguard’s formulaic but, until 2022, highly successful approach.

That, of course, ignores the fact that many DFMs run at least some portfolios in a similar way to Vanguard. In MPS, for example, many providers have a subset of their range that is predominantly passive.

More to the point, a new cohort of firms actually specialise in using a similar approach to the US giant, including Ebi Portfolios and Timeline. Both are experiencing some of the fastest growth in the MPS market.

Ebi, bought by Parmenion in 2022, originally stood for ‘evidence-based investing’ – a phrase adopted by this group to describe their ultra-low cost and passive-based approach, and which infuriates some competitors.

Sparrows Capital, born out of a family office, forms part of the same group and launched its SCore MPS in 2020. Mark Northway, an investment manager at Sparrows, said the company had beaten LifeStrategy over the past five years across its range using an approach ‘identical to a large degree’.

The SCore Market Equity 60% portfolio delivered 41.5% in the five years to the end of 2023 versus 33.6% for Vanguard LifeStrategy 60% Equity. While the returns are simulated until February 2020, Northway said the same gains had been achieved for other clients using the same rules that govern model portfolio positioning.

Northway said Sparrows’ key difference versus LifeStrategy was that it limits home bias in its equity and bond holdings (the Vanguard range has 35% of its fixed income and 25% of its exposure in the UK).

Sparrows also limits the duration of the portfolios to about four-and-a-half years. Like MAIA, those elements together meant that as UK gilts sold off heavily in 2022, Sparrows’ losses were milder.

However, Northway acknowledged that Vanguard’s longer-duration exposure would mean LifeStrategy enjoys a strong rebound when interest rates are finally cut. ‘Yes, and it will hurt us in a long [bond] bull market,’ he said.

Northway also pointed to Vanguard’s decision when launching LifeStrategy in an MPS in mid-2022 to offer a tweak to the approach.

While the Vanguard LifeStrategy MPS Classic range exhibits the same home bias as the funds, the LifeStrategy MPS Global Range is based on market capitalisation. That brings the weighting to UK assets much lower, in line with their status in global equity and bond indices.

Northway said that was a ‘specific response’ to the detrimental effect of home bias in 2022 and prior years.

A Vanguard spokesperson said the decision to launch both MPS ranges was intended ‘to give advisers the choice of wrapper and asset allocation that best meet their needs’ and that it was a matter of personal preference.

It is believed Vanguard actually started the planning process long before 2022.

2024: The battle is still on

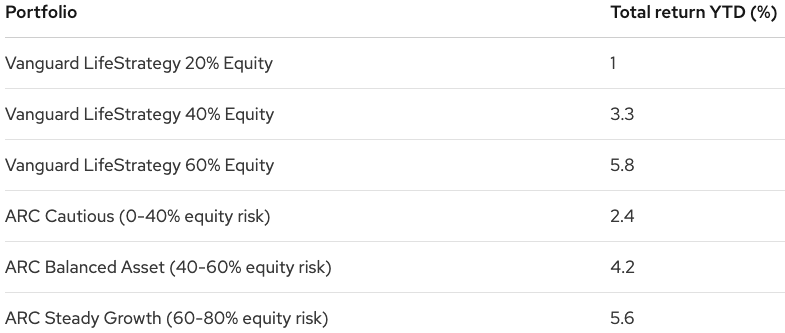

Source: Morningstar, ARC (Data at 30/6/24)

Over the first half of the year, as interest rate cuts were repeatedly delayed, ARC indices were able to run ahead of LifeStrategy in those lower equity categories.

While the Vanguard LifeStrategy 20% Equity fund delivered a 1.1% return in the first six months of the year, the equivalent ARC Cautious index (0-40% risk relative to equities) was up 2.4%.

The timing and depth of interest rate cuts will likely be a key determinant of what comes next. But a broadening out of equity markets – as opposed to technology giants driving returns – could mark another sea change.

As covered in our original DFMs versus LifeStrategy piece, many UK investment managers hope traditional active management will outperform in that scenario.

However, curiously, the likes of Sparrows, Ebi and Timeline could also benefit from a changing dynamic. As well as having ‘market-based’ products, which use regular equity and bond tracker funds, all have factor-based strategies.

These also make use of index funds that overweight factors, such as small-cap and value stocks, which have delivered better returns than the broader market over very long periods. Even though those exposures have held back the relevant portfolios since launch, Northway still believes in the investment case for doing so.

‘Our view is still that these [factors] are academically valid,’ he said.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.