1,100 portfolios were analysed from 67 providers and the MAIA Smart Beta Cautious and MAIA Blended Cautious portfolios are amongst the top performers in the 20-40% Equity sector, highlighting the strong performance that MAIA continues to produce.

The full article is below.

Revealed: The MPS providers topping the performance charts

Exclusive Citywire analysis of the performance of more than 1,100 MPS portfolios reveals the providers with the best all-round records.

A new breed of specialist discretionary fund manager (DFM) is topping the MPS performance charts ahead of established wealth managers and fund groups, exclusive Citywire research reveals.

Analysis of the performance of more than 1,100 managed portfolio service (MPS) portfolios run by 67 providers has revealed the strongest ranges in a fast-growing but often hard-to-scrutinise sector.

Citywire’s research – using data from Morningstar, MPS ratings provider Mabel Insights and MPS managers – has highlighted the strong performance of younger DFMs.

These include Fundhouse, founded in 2007 and running £1.2bn of MPS assets; Tatton, having grown to £17.6bn of assets since its 2013 launch; MAIA, established in 2016; and One Four Nine Group, which is five years old. The platform Fundment, established in 2014, has also delivered strong performance across its MPS range.

Among more established wealth managers, Waverton and Quilter stand out for the returns from their MPS ranges. HSBC, meanwhile, leads the way among larger asset managers in the MPS performance charts.

At the other end of the spectrum, one clear trend is the disappointing returns of sustainable ranges during a tough period for ESG funds.

The top performers

MPS ranges can be sprawling. Providers frequently offer not just portfolios with different risk levels, but often active, passive and blended versions of each.

In assessing providers, Citywire examined each DFM’s performance across its ranges versus comparable funds in Morningstar’s six biggest MPS sectors: EEA Model GBP Allocation 0-20%, 20-40%, 40-60%, 60-80% and 80%+ Equity, and EEA Model Global Large Cap Blend Equity.

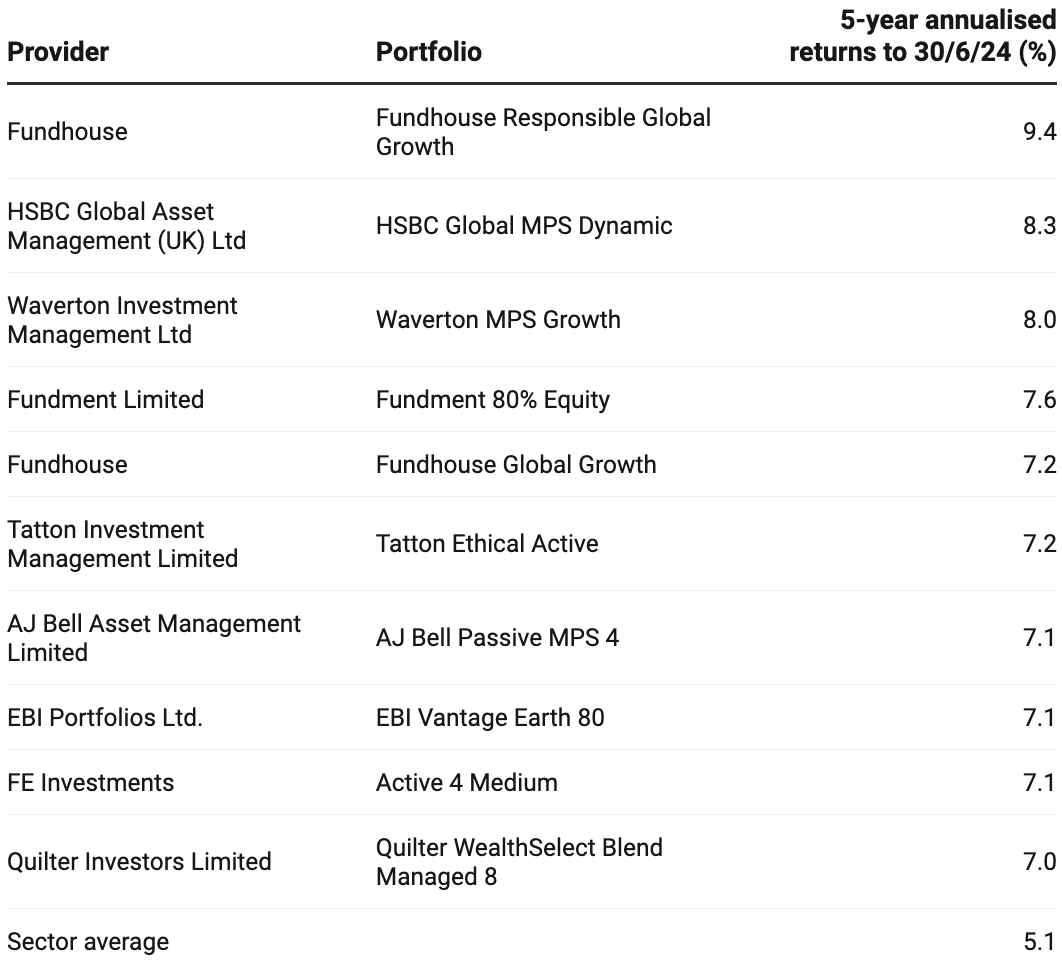

Top performers in the 60-80% Equity MPS space

Source: Morningstar, Mabel Insights, provider factsheets Get the data Created with Datawrapper

For portfolios mapping to Morningstar’s 60-80% Equity category, Fundhouse, which spread into the UK from South Africa in 2010, is the strongest performer over five years. In the half decade to the end of June, the Fundhouse Responsible Global Growth delivered an annualised 9.4% gain. The category average over the same period was 5.1%, according to Citywire calculations.

Many of the top providers in higher-equity categories are passive or strongly passive-leaning. However, the Fundhouse portfolio uses a concentrated selection of equity and bond funds with a clear leaning towards active. Morningstar holdings data indicates it entered 2022 with about 15% in cash and short-duration bonds, helping to limit losses as rates rose. The only other fixed income holding was Fidelity Strategic Bond.

Among equities, the Dodge & Cox Worldwide Global Stock fund, an 11% holding, has been a top performer and has beaten global markets over three years.

AJ Bell, Fundment, HSBC and Waverton portfolios have also performed strongly, as they have across multiple sectors. It is worth noting that those topping the charts in the 60-80% Equity sector tend to have an equity weighting at or close to the 80% mark – a clear factor in boosting performance relative to peers. The AJ Bell, Fundment and HSBC portfolios in the table also only use passive funds.

Like Fundhouse, Waverton is another exception to that pattern, with its MPS portfolios split between in-house active equity, sterling bond, real asset and absolute return funds.

Also noteworthy, considering the weaker performance from many sustainable providers over recent years, is both the return for Fundhouse Responsible Global Growth and the 7.2% annualised return delivered by the Tatton Ethical Active portfolio.

Where has the data come from?

Citywire has sourced data for this series on MPS performance from investment data group Morningstar, MPS ratings provider Mabel Insights and MPS managers.

That has enabled us to build an extensive picture of performance across Morningstar’s six biggest MPS sectors: EEA Model GBP Allocation 0-20%, 20-40%, 40-60%, 60-80% and 80%+ Equity, and EEA Model Global Large Cap Blend Equity.

Our analysis has encompassed 1,108 MPS portfolios, with all returns quoted net of MPS provider fees and the costs of their underlying funds.

How those return figures have been calculated differs slightly depending on how they were sourced.

Morningstar’s data is based on the group’s own calculations of MPS performance using portfolio holdings data provided by MPS managers. MPS providers who sign up to its database are required to submit updated portfolios within five days of any rebalance or trade.

Mabel Insights’ performance data is sourced either directly from partner MPS providers or from providers’ factsheets. In cases where data was available from both sources, differences were largely marginal.

Where data has been sourced other than from Morningstar, Citywire has mapped portfolios to the data provider’s sectors based on asset allocation.

Citywire has used data from Morningstar, Mabel Insights and MPS providers in a bid to capture the return from as many portfolios as possible.

No Timeline?

MPS is such a nascent space that even some of the most popular operators do not have five-year track records yet.

Timeline, which has grown rapidly since its 2020 MPS launch, misses out on the five-year figures on that basis. However, the Timeline Tracker 80 and Tracker 70 portfolios have been some of the strongest performers over three years, returning an annualised 6.8% and 5.6%, respectively. The 60-80% category average was just 2.6% over that time.

Also notable in the five-year table is the presence of EBI Portfolios, which uses a similar mix of exclusively passive funds to Timeline.

In the 40-60% Equity sector, Fundment, Waverton and Fundhouse again feature towards the top of the performance charts over five years. The Waverton MPS Cautious portfolio stands out for achieving a 5.1% annualised return – versus the 3.6% category average – despite running an equity weighting of a little above 40%.

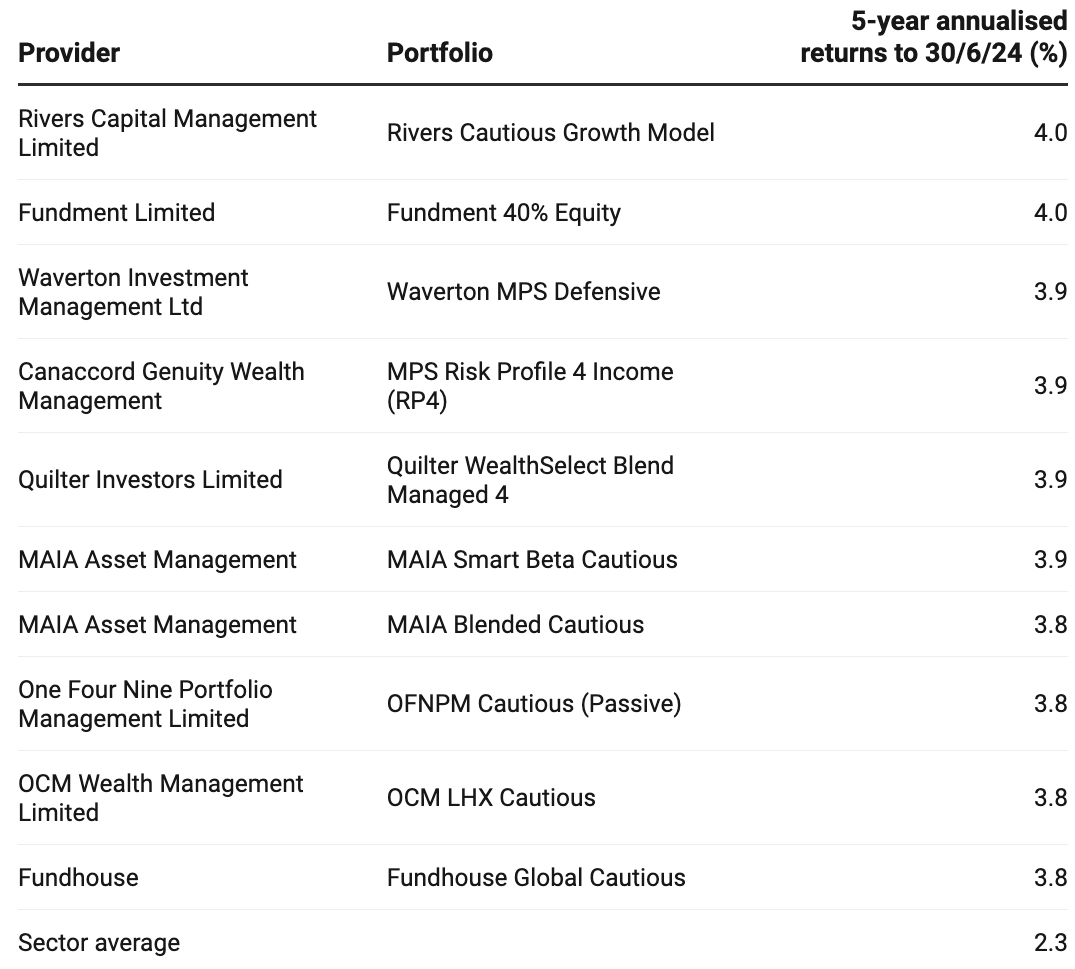

Best performers in the 20-40% Equity sector

Source: Morningstar, Mabel Insights, provider factsheets Get the data Created with Datawrapper

Turning to sectors where funds have lower equity weightings, there is some turnover among the names of the best-performing providers.

These ‘lower risk’ categories are also where more active DFMs have had the most success compared with passive-led approaches in recent years, as covered in previous Citywire research on the performance of DFMs versus Vanguard’s juggernaut LifeStrategy range.

In the 20-40% Equity category, Waverton, Fundment and Quilter feature high up the performance table, but the Rivers Cautious Growth Model takes top spot, with a 4% annualised gain over five years (just ahead of Fundment once you get into the decimals). That compares with the 2.3% average in the sector.

The Rivers portfolio was also notable for limiting losses to 4.4% over 2022 amid a historic bonds and equity selloff, in one of the smallest drawdowns in its sector.

Rivers Capital Management was set up in 2016 and involves several people previously connected with the defunct Newscape Capital Group.

The firm’s portfolios use a mix of active and passive, but the Rivers Cautious Growth Model has held a Royal London money market fund as its top holding since late 2023, according to Morningstar data. The TwentyFour Monument Bond fund has also been a large and strong-performing holding, on top of significant absolute return exposure.

While not always beating their benchmarks, equity fund holdings like De Lisle America and Vermeer Global have also done better than most at keeping up with runaway indices in recent years.

MAIA’s lower-risk portfolios have also performed strongly. The firm’s investment manager Simon Jackson told Citywire recently that the group had been able to beat equivalently risky LifeStrategy funds by moving away from bonds as a diversifying and hedging asset. Instead, the firm’s ‘large alternatives bucket’ has included assets such as funds of structured products, infrastructure and gold.

It is worth noting that the likes of Ebi and Timeline, with an absence of alternatives exposure, fall lower down in the performance tables in this category but are by no means near the bottom.

For example, the Ebi Vantage World 30 Model has delivered 2.5% annualised over five years, above the sector average.

This website is aimed at Independent Financial Advisers, please tick the box to confirm that you are an IFA before entering the website.